north carolina estate tax certification

At least 72 hours of CLE credits in estate planning and related fields. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes.

![]()

North Carolina Estate Planning Elder Law Articles Carolina Family Estate Planning

Walk-ins and appointment information.

. However when ATRA was passed back in 2012 North Carolina repealed its. Before The Clerk County. Owner or Beneficiarys Share of NC.

88 North Carolina Decedent Name. NC K-1 Supplemental Schedule. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. If you believe the data in this table is incorrect please notify Dave Duty in the. Appointments are recommended and walk-ins are first come first serve.

2305 Standards for Certification as a Specialist in Estate Planning and Probate Law. The required information includes the name of decedent the date 0f death and the last four digit of the social security number of the decedent. Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399.

Account Annual Final Report. Estate Tax Certification 87 North Carolina County Information. At least 45 hours shall be in estate planning and probate law provided however that eight of the 45 hours may be in the related areas of elder law Medicaid planning and guardianship.

Instant access to fillable Microsoft Word or PDF forms. Ad Download Or Email NC E-590 More Fillable Forms Register and Subscribe Now. APPLICATION AND PETITION FOR SUMMARY ADMINISTRATION OF ESTATE WITHOUT A WILL.

Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. North Carolina law requires the Department of Revenue to provide a certification and continuing education program for county assessors and appraisers. Estate Tax Certification For Decedents Dying On.

Waiver Of Personal Representatives Bond. The certification program shall be available to Tax Collectors Deputy Tax Collectors and Assistants support staff. Estate Tax Certification For Decedents Dying On Or After 1199.

Estate Tax Certification For Decedents Dying On or After 1199 Files. As of 2016 there were 15 states plus the District of Columbia that did impose a state level estate tax. The following table may be used to verify data in our records for those individuals.

Requirements for Certification by the North Carolina Tax Collectors Association Revised May 9 2012 A. Iv prepared reviewed or supervised the preparation of federal estate tax returns North Carolina inheritance tax returns and federal and state fiduciary income tax returns including representation before the Internal Revenue Service and the North. Estate Tax Certification For Decedents Dying On.

USLF amends and updates the forms. Inheritance And Estate Tax Certification North CarolinaStatewideEstate Letters North CarolinaStatewideEstate. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40.

This form should be completed if the North Carolina Decedent passed away on or after January 1 1999. However there are 2 important exceptions to this rule. North Carolina Judicial Branch Search Menu Search.

Like many other states North Carolina previously levied an estate tax on estates probated in the state. A form showing an estate tax certification for decedents dying on or after January 1 1999 in North Carolina is presented. As of March 1 2019 the Davidson County Tax Department has implemented the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution adopted by the Davidson County Board of Commissioners on August 14 2018.

If a North Carolina resident inherits a property. Duty to Furnish a Certificate-On the request of any of the persons prescribed in subdivision a 2 below the tax collector shall furnish a written certificate stating the amount of taxes and special assessments for the. STATE OF NORTH CAROLINA File No.

Beneficiarys Share of North Carolina Income Adjustments and Credits. However the State of North Carolina is not one of those states. USLF amends and updates the forms as is required by North Carolina statutes and law.

Division of Water Resources Tax Certification. It is first advisable that any business read the North Carolina Solid Waste Management Rules regarding the standards for special tax treatment before applying. Inheritance And Estate Tax Certification.

Affidavit Of Notice To Creditors. Link is external 2021. Effective January 1 2013 the North Carolina legislature repealed the states estate tax.

Inventory For Decedents Estate. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. IN THE MATTER OF THE ESTATE OF.

The state exemption amount was tied to the federal one which means that for deaths in 2012 estates with a total. In the General Court Of Justice. Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax.

Find a courthouse Find my court date Pay my citation online. County Assessor and Appraiser Certifications. These files may not be suitable for users of assistive technology.

County Assessor and Appraiser Certification Table NCDOR. Application for Extension for Filing Estate or Trust Tax Return. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. Get Access to the Largest Online Library of Legal Forms for Any State. If you are having trouble accessing these files you may request an accessible format.

Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399. Appointment of Resident Process Agent. FOR DECEDENTS DYING PRIOR TO JANUARY 1 1999 Name Of DecedentDate of Death See Side Two GS.

This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes. Tax Certification Program North Carolina offers a tax exemption on equipment and facilities used exclusively for recycling and resource recovery. The North Carolina County reviewing the tax status of the estate must be reported along with the file number it has assigned to this matter.

For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. This form should be completed if the North Carolina Decedent passed away on or after January 1 1999. This Resolution states that the Register of Deeds will no longer accept any deed transferring.

The balance may be in the related areas of taxation business organizations real. Tax Collectors must meet the requirements as set forth in GS 105-349 of the Machinery Act.

Understanding North Carolina Inheritance Law Probate Advance

North Carolina Estate Tax Everything You Need To Know Smartasset

Why Certificates Of Service Are Important Rice Law

Waiver Of Personal Representatives Bond E 404 Pdf Fpdf Doc Docx North

Governor S Volunteer Service Award Dare County Nc

Complete Guide To Probate In North Carolina

North Carolina Estate Planning Elder Law Articles Carolina Family Estate Planning

North Carolina Estate Planning Elder Law Articles Carolina Family Estate Planning

Complaint For Certificate After Death Pdf Fpdf Docx Massachusetts

North Carolina Estate Tax Everything You Need To Know Smartasset

Building Permits Inspections Dare County Nc

North Carolina Estate Tax Everything You Need To Know Smartasset

Affidavit And Collection Disbursement And Distribution E 204 Pdf Fpdf Doc Docx

Complete Guide To Probate In North Carolina

Complete Guide To Probate In North Carolina

Understanding North Carolina Inheritance Law Probate Advance

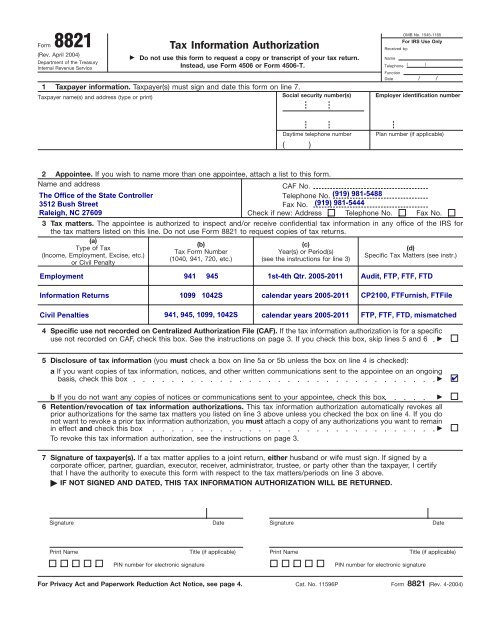

Irs Form 8821 Tax Information Authorization North Carolina Office